There are quite a few ways to add value to your business you own or consult aside from increasing profits. For instance, investors or strategic buyers will pay more for the procedures that made the business a success. Owners may take a nonchalant approach because it seems to obvious to them what to do like training employees to do their job amazingly well or working with customers. But fast forward a year or so and some of that training expertise becomes a chore again and that’s why SOP’s will come in handy and add serious value to business.

Where is the Value in your Business?

Part of our job as M&A Advisors is to help find the value in a business. What makes it special? The other large part of where we earn our fee is locating the types of buyers who’ll find your business attractive and even more advise the business owner on what to do to become even more attractive to those buyers who’ll then pay a premium.

There are unique attributes of a company that make it more attractive to a possible acquirer and/or more valuable. Certainly, the numbers are important, but potential buyers will also look beyond them. Factors that make your company special or unique can often not only make the difference in a possible sale or merger, but also can dramatically increase value.

Brand name or identity

Is the brand strong? Needless to say that is worth a lot.

Do any of your products have a well recognizable name? It doesn’t have to be Kleenex or Coke, but a name that might be well known in a specific geographic region, or a name that is identified with a specific product. A product with a unique appearance, taste, or image is also a big plus. For example, Cape Cod Potato Chips have a unique regional identity, and also a distinctive taste. Both factors are big pluses when it comes time to sell.

Dominant market position

A company doesn’t have to be a Fortune 500 firm to have a dominant position in the marketplace. Being the major player in a niche market is a dominant position. Possible purchasers and acquirers, such as buy-out groups, look to the major players in a particular industry regardless of how small it is.

Customer lists

Newsletters and other publications have, over the years, built mailing lists and subscriber lists that create a unique loyalty base. Just as many personal services have created this base, a number of other factors have contributed to the building of it. The resulting loyalty may allow the company to charge a higher price for its product or service.

Intangible assets

A long and favorable lease (assuming it can be transferred to a new owner) can be a big plus for a retail business. A recognizable franchise name can also be a big plus. Other examples of intangible assets that can create value are: customer lists, proprietary software, an effective advertising program, etc.

Price Advantage

The ability to charge less for similar products is a unique factor. For example, Wal-Mart has built an empire on the ability to provide products at a very low price. Some companies do this by building alliances with designers or manufacturers. In some cases, these alliances develop into partnerships so that a lower price can be offered. Most companies are not in Wal-Mart’s category, but the same relationships can be built to create low costs and subsequent price advantages.

Difficulty of replication

A company that produces a product or service that cannot be easily replicated has an advantage over other firms. We all know that CPA and law firms have unique licensing attributes that prevent just anyone off of the street from creating competition. Some firms have government licensing or agreements that are granted on a very limited basis. Others provide tie-ins that limit others from competing. For example, a coffee company that provides free coffee makers with the use of their coffee.

Proprietary technology

Technology, trade secrets, specialized applications, confidentiality agreements protecting proprietary information – all of these can add value to a company. These factors may not be copyrighted or patented, but if a chain of confidentiality is built – then these items can be unique to the company.

There are certainly other unique factors that give a company a special appeal to a prospective purchaser and, at the same time, increase value. Many business owners have to go beyond the numbers and take an objective look at the factors that make their company unique.

Is it better to own a big chunk of a small business or a minority stake in a big company?

It’s one of the fundamental questions all owners must wrestle with. Owning a relatively small slice of a big pie has worked out well for both Elon Musk and Jeff Bezos, who recently traded places on the list of the world’s richest person. Musk still owns around 20% of Tesla, and Bezos controls about 10% of Amazon, so they both have chosen to sell most of their company to fund their ambitions. The success of their bet has been amplified lately given the stock market’s run over the last 12 months.

However, selling part of your business comes with some significant downsides. Let’s take a look at four reasons it’s better to own a big slice of a smaller pie.

Operational Freedom

The most obvious benefit of keeping all of your shares is that you get to decide how to run your company. Nobody can tell you what products to launch or markets to enter. You are the king or queen of your kingdom and can decide the rules.

No Pressure to Exit

Tim Ferriss, the author of five books, including the wildly popular New York Times bestseller The 4-Hour Workweek, recently urged his Twitter followers to consider their endgame before investing in a business: “Before you get into an investment position, know-how and when you're going to get out, or at least how and when you will reevaluate. Getting in is the easy part….”

Once you accept outside investment in your business, you must try to earn your shareholders a return. For your investors to realize a gain, you must sell your company (or part of it). Needing to sell so your investors can realize a return means you give up the option to run your business forever and need to start thinking about how your shareholders will get liquid. Some will pressure you while others will wait patiently, but the exit clock starts ticking once you take outside investment.

Nobody Ahead of You in Line

Sophisticated outside investors often demand preferred returns when they invest in your company, which can undermine your take from a sale.

For example, Ana Chaud started Garden Bar to offer fast-casual salads to Portland hipsters. The first store was a success, but the restaurant industry’s thin margins inspired her to grow to get some economies of scale. She raised two rounds of outside capital, including one from a group of convertible noteholders. Chaud skimmed the term sheet but trusted her investors, so she didn’t think much about a clause that gave noteholders 2.5 times their money if she sold the business before the note expired.

Chaud continued to grow to nine locations, with a tenth on the way, when she attracted an exciting offer from Evergreens, Seattle’s fastest-growing salad restaurant. Things were going according to plan right up until Chaud’s lawyer pointed out the investor's clause, which had the potential to wash out all her equity.

Chaud agreed to give the proceeds of her acquisition to investors. She negotiated an earn-out, which she hoped would allow her the possibility of a return on her years of sacrifice. Then COVID-19 hit, Portland restaurants were closed, and Chaud ended up with nothing.

Avoid an $80 Million Mistake

The most obvious reason to hang on to your shares is to avoid dilution. When your company is not worth very much in the early days, it can be tempting to give away equity to attract a key team member, but it could end up costing you dearly if you’re too generous.

Take a look at the story of Greg Alexander, who started Sales Benchmark Index (SBI). Alexander started the sales consultancy at his kitchen table and, early into his tenure, gave two employees a quarter share in his business. Ten years later, Alexander ended up selling SBI for $162 million, prompting him to refer to easily giving up half the company as an “$80 million mistake.”

Given the runaway success of some high-profile stocks of late, it can be tempting to consider raising money to fund your growth, but there are still several benefits to owning a big slice of a small pie.

---

Kris Moe,

M & A Business Advisors

Covid-19 Small Business Assistance from Small Business Administration

The U.S. Small Business Administration is offering designated states and territories low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). Upon a request received from a state’s or territory’s Governor, SBA will issue under its own authority, as provided by the Coronavirus Preparedness and Response Supplemental Appropriations Act that was recently signed by the President, an Economic Injury Disaster Loan declaration.

Any such Economic Injury Disaster Loan assistance declaration issued by the SBA makes loans available statewide to small businesses and private, non-profit organizations to help alleviate economic injury caused by the Coronavirus (COVID-19). This will apply to current and future disaster assistance declarations related to Coronavirus.

SBA’s Office of Disaster Assistance will coordinate with the state’s or territory’s Governor to submit the request for Economic Injury Disaster Loan assistance.

Once a declaration is made, the information on the application process for Economic Injury Disaster Loan assistance will be made available to affected small businesses within the state.

SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance and can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.

These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses. The interest rate for non-profits is 2.75%.

SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

SBA’s Economic Injury Disaster Loans are just one piece of the expanded focus of the federal government’s coordinated response, and the SBA is strongly committed to providing the most effective and customer-focused response possible.

For questions, please contact the SBA disaster assistance customer service center at 1-800-659-2955 (TTY: 1-800-877-8339) or e-mail disastercustomerservice@sba.gov.

Is Starting With A Higher Selling Price A Good Strategy? Showing An Asking Price?

Is starting with a higher selling price a good strategy when selling a small business? or even showing an asking price? I have some definite ideas about this concept and would like to share along with other Advisors, Brokers, Agents contributors on BizBen. What are your thoughts on asking prices?

I (Rob Hartman is a professional business broker I work with) recently had a client who engaged my services to help them sell their business. I performed a Market Value Analysis and came up with a listing price that I felt would serve them best in the efforts to sell their business. They were excited to move forward and sell their business with one small change. They wanted to increase the listing price of the business substantially, and advertise the business for sale at a much higher price than I had recommended. The owner's reasoning was that we could always lower the price later if it didn't sell, and if there was someone out there willing to pay extra for the business, they didn't want to leave any money on the table.

I informed the business owner that I didn't agree with this strategy for a few reasons. First of all, there will be several similar businesses for sale at the same time and if a potential buyer needs to narrow his decision down to 2 or 3 choices, the business that is priced too high will not get the consideration because they didn't make the first cut. Second, in the eyes of a savvy business buyer, if a seller is unrealistic with his selling price, he will probably be difficult to deal with in other aspects of the business buying process and that alone will keep people from inquiring for more info. Third, a business buyer worked very hard for the money to buy a business and they aren't going to be frivolous with that decision. They have several options of what to do with their money including doing nothing at all.

However, they decided not to heed my advice and do it their way first. The owner said, "Let's try it my way first, then we can try it your way." I advised him that starting high and lowering later may have adverse effects that could hurt his chances of selling his business at all, but nevertheless we went with the price high strategy and well here we are 6 months later at the lower price for 3 months and the business still isn't sold. Even though, several other similar businesses have sold at similar pricing, this owners business remains unsold.

I am curious to know, how the business buying and selling community regards the "price high, lower later" strategy regarding pricing businesses for sale. Has it ever worked for you in the past? All other things being equal, does a business that starts with a high price and lowers later, hurt its chances of selling.

Tap into your 401K retirement savings, without penalty, to buy a business

What is a ROBS? ROBS is an arrangement in which prospective business owners use their retirement funds to pay for new business start-up costs. ROBS plans, while not considered an abusive tax avoidance transaction, are questionable because they may solely benefit one individual – the individual who rolls over his or her existing retirement funds to the ROBS plan in a tax-free transaction. The ROBS plan then uses the rollover assets to purchase the stock of the new business.

Promoters aggressively market ROBS arrangements to prospective business owners. In many cases, the company will apply to IRS for a favorable determination letter (DL) as a way to assure their clients that IRS approves the ROBS arrangement. The IRS issues a DL based on the plan’s terms meeting Internal Revenue Code requirements. DLs do not give plan sponsors protection from incorrectly applying the plan’s terms or from operating the plan in a discriminatory manner. When a plan sponsor administers a plan in a way that results in prohibited discrimination or engages in prohibited transactions, it can result in plan disqualification and adverse tax consequences to the plan’s sponsor and its participants.

Click here to read it first hand at IRS site.

And to find out more on how to buy a business call a business broker like Kris Moe at 707-529-6458.

It's a Great Time to Be Buying or Selling a Business

The Market is Hot: Retiring Baby Boomers and Rising Revenues Fuel Record Small Business Sales

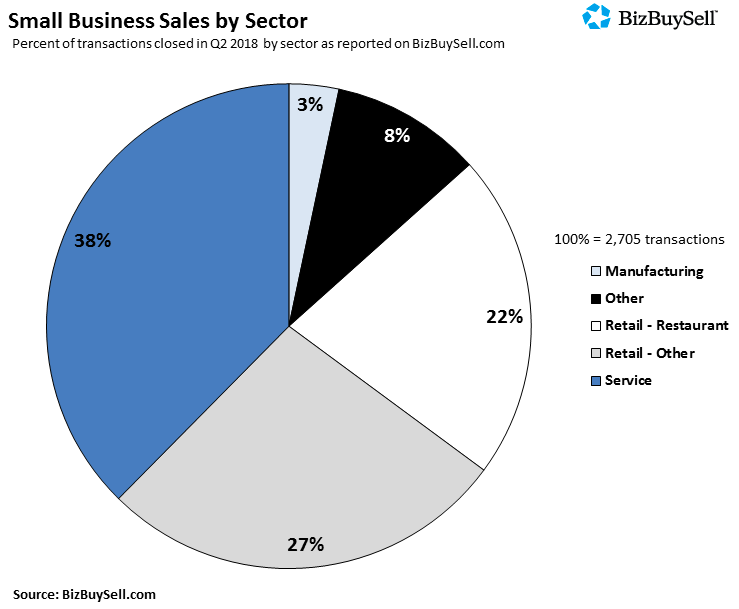

BizBuySell.com's Second Quarter 2018 Insight Report examines the transactions and demographics behind the record levels of small businesses changing hands

San Francisco, CA - BizBuySell.com, the Internet's largest business-for-sale marketplace, reported today a record number of small businesses changing hands in the first half of 2018. The growth can largely be attributed to a growing number of Baby Boomers exiting their business as well as improving business financials. The full results are included in BizBuySell's Q2 2018 Insight Report, which aggregates statistics from business-for-sale transactions reported by participating business brokers nationwide.

A total of 5,383 businesses were reported sold in the first two quarters of 2018, putting the year on pace to surpass 2017's record-high of 9,919 transactions. In Q2 alone, 2,705 businesses changed hands, an increase of 6.7 percent over the same time last year and the most of any quarter since BizBuySell began tracking data in 2007.

The $526,048 median revenue of businesses sold in the second quarter reached a new high with a 7.4 percent increase from last year, while median cash flow grew 3.4 percent to $120,000. These stronger financials are catalysts for gains in asking and sale prices over the past year. Asking prices increased 4 percent from Q2 of last year to $260,000, raising the median sale price 4.4 percent to $239,000.

While buyers are dishing out a little more at the negotiating table, BizBuySell data reflects a win-win for both parties. Sellers get a little extra cash from the deal, while buyers are taking ownership of businesses with better financial footing. The former is of special importance to the growing number of Baby Boomers relinquishing their business in turn for the reward of retirement.

For those yet to take advantage of the hot market, for-sale data shows that it's still an opportune time to jump in. A 5.1% increase in active listings were reported in the second quarter of 2018 compared to last year, extending a long trend that started in 2012. There are no guarantees in small business, however the state of the economy and demographic trends point to a rising tide. In fact, the National Federation of Independent Business (NFIB) small-business optimism index rose 3 points to 107.8 this past May, the second-highest level in the index's 45-year history.

"The current business-for-sale market is a great reflection of today's economic and demographic environment," Bob House, president of BizBuySell.com and BizQuest.com, said. "As America continues to see a swell of Baby Boomers reach retirement age, the market will likely continue to see a strong inventory of businesses for sale. Meanwhile those same businesses, many of which dug their way out of the last recession, now have the financial performance they need to earn an acceptable sale price."

Transactions Reflect Generational Shift as Baby Boomers Hand Businesses to Younger, More Diverse Buyers

According to BizBuySell's latest demographic survey, Baby Boomers still own the majority share (53 percent) of small businesses. Demographically, these Boomers make up a fairly consistent group, with over 82 percent Caucasian males. Two in three Baby Boomers have owned more than one business and 68 percent have owned their current business for more than 10 years. More importantly for the market, nearly 60 percent of Baby Boomers plan to sell their business within the next two years or less. Based on this data, we don't expect market supply to slow down anytime soon, but some data suggests we could see a shift in the makeup of incoming business owners.

A deeper dive into the demographics of today's market shows a transition to a more diverse group of business owners. Incoming buyers are less likely to identify as Caucasian (65 percent) than current owners as a whole (71 percent). They are younger, with the majority less than 50 years old and despite both groups leaning Republican, buyers are 25 percent more likely to be Democrats.

Politically, immigration remains a hot topic in our country but its impact on the small business community is profound. A third of buyers are non-natural born citizens, and 64 percent of these are first-generation immigrants and another 16 percent are second-generation. That's a big jump from non-natural born citizen current owners, in which just 48 percent are first generation and 10 percent are second generation.

Finally, while women still account for the minority of small business owners (22%), female owner demographics showed a younger, more diverse group as well. For example, twice the percentage of female owners are in their 20s as compared to men. In addition, twice the percentage of female business owners identify as African American compared to men.

Indicators Point to Continued Strong Pace in Second Half of Year

Overall, the rising financial performance of small businesses and the influx of sellers ready to enter the market provide for an optimistic outlook of the rest of 2018. Sellers will continue to take advantage of high sale prices and buyers will be able to find quality businesses within the large supply of listings.

"Baby boomers are trailblazers when it comes to entrepreneurship" said Bill Luce, President of Transworld Business Advisors, one of the nation's top business brokerages. "As Baby Boomers continue the strong tailwind, this market trend is sure to stay in style for years to come."

Despite the favorable setup, external factors exist that could sway the markets trajectory. For example, it remains to be seen what impact changes to the U.S. immigration policy will have on the market over the long term. The same goes for the U.S. China trade war, where tariffs could have a direct effect on the small business space.

In a potentially more favorable light, the Tax Cuts and Jobs Act passed in 2017 could cause the number of business transactions to further spike. Under the new tax law, many owners now benefit from a 20 percent deduction for qualified business income. If owners choose to re-invest those savings back into their business as early data suggests, the end result will likely be an increasing number of attractive businesses hitting the market.

"Our survey indicated 32 percent of all current small business owners plan to sell in the next two years so this trend will likely continue well into the future," House said. "It will be particularly interesting to watch the demographics of an average small business owner change and how this younger generation's new ideas will push forward an already successful small business environment."

Get in contact with Kris Moe to learn more about the steps to value or sell your business- 707-529-6458

How to Market Selling your Business

Marketing Program

We Are The 800 lb Gorilla In Marketing Businesses For Sale.

There’s a reason we sell more businesses than any other business brokerage network. Whether it’s online with the internet or using traditional marketing venues, we’ll produce impactful communication pieces and present your business to the right target audiences.

We’ll work with you to develop a marketing plan that makes sense for you and your business. Generally speaking, our marketing services include:

- Advertising on the biggest and best internet websites featuring Businesses For Sale

- Production of confidential promotional letters and Confidential Business Profiles (CBP)

- Production of a professional Confidential Business Review (CBR)

- Targeted email marketing to our proprietary database of buyers

- Research and determination of potential, strategic, buyers

- Education and utilization of our extensive Sunbelt broker network and national/international Sunbelt offices

The majority of potential business buyers will begin their search online.

We make sure they find your business.

Internet presence is one of the key attributes you should evaluate when choosing your business brokerage firm. For Main Street businesses and select larger businesses, your business will be included on the Sunbelt website – the largest proprietary listings database in the world. We may also promote your business-for-sale on additional strategic internet websites where buyers search looking at businesses for sale.

Let’s talk confidentially about your business and goals all at no cost or obligation. Contact Kris Moe today at 707-529-6458, to start planning the sale of your business.

I'm Considering Selling my Business

Selling Cycle

1. Determine a Realistic Price Range

If you price your business too high, you'll scare away buyers. If you price it too low, you'll lose out. To figure out a range that's realistic, you can use one of several methods -- and then maybe blend the results. For example, you can base the price on the value of the business's assets, and add in a sum for the goodwill the business has developed. Or you can see how much comparable businesses in your industry and locale have recently sold for. Or you can use an industry formula (for example, a value based on the number of units sold annually or a multiple of average earnings).

2. Understand the Tax Consequences

Taxes can take a huge bite out of the money you receive for your business. It pays to know just how big that tax bite will be -- and to try to lower it, most likely with help from a CPA or other tax expert.

Your tax bill will be influenced by two key factors: How your business is legally set up and -- in the case of a corporation or LLC -- whether you're selling the assets or the entity. Sales of all sole proprietorships and almost all partnerships are asset sales. So are the sales of many corporations and LLCs.

3. Look Good for a Sale

The getting-ready process includes not only sprucing up your premises, but getting your numbers in good shape. Consider recasting your tax-return numbers for prospective buyers. This can involve, for example, adding back to your profits discretionary expenses such as medical insurance for you and your family, travel and entertainment, business vehicles, memberships and subscriptions, and salaries and bonuses paid to family members.

In recasting your tax numbers, you're not deceiving either the IRS or prospective buyers. You're simply pointing out that the buyer may prefer not to spend money on some of these items in the future.

4. Seek Potential Buyers

If your business is well known, word that it's for sale may be enough. Or, possibly someone close to you -- an employee, a friend, or a customer -- could be a prospect. But more likely, you'll need to reach out to a bigger pool. This often includes putting ads in newspapers and trade publications, and on business-sale websites.

You may want to engage a business broker like me to reach more buyers, or to keep your plans from going too public too fast. We have great reach and do over 1,500 deals a year!

5. Negotiate Your Deal

In working out the terms of the sale, some key issues include whether you'll sell the business entity or just its assets, what assets (like a truck) you want to keep, and how the buyer will pay you (usually, a down payment plus installments).

6. Sign a Sales Agreement

You'll need to put the deal in writing. Among other things, your agreement should list and value the assets the buyer is purchasing, list any contracts the buyer is assuming, and include protections that assure you'll get paid the full sale price. If you attempt the first draft of the sales agreement yourself, have it reviewed by a business lawyer to make sure you've covered all the bases.

7. Plan for the Closing

The closing is the meeting at which you transfer the business to the buyer. To reduce last-minute hassles, make a checklist of all the papers you and the buyer will need to bring -- everything from the documents and money associated with the transfer to your alarm codes, keys, and customer lists.

What is the Best Way to Exit a Business

What is the Best Way to Exit a Business?

by Bill Mitchell Business Broker at Sunbelt Business Sales in San Francisco Bay Area

All business owners eventually face the question of what will they do with the business they have built. There are a myriad of reasons for wanting to exit a business, such as retirement, relocation, poor health, divorce, burn-out, or the desire to pursue other business interests, but there are surprisingly few ways to actually do it. This short write-up is not a comprehensive review of these options, but is a summary of what they are and some of their merits and issues.

Four Primary Courses of Action

That's not many options is it? I have listed below these options in the order (highest to lowest) of the value you may expect to realize from each.

- Put the business on the market and sell to an outside buyer.

- Create an Employee Stock Ownership Plan (ESOP) and sell your business to it.

- Sell it to insiders: your employees or family members.

- Close down the business and liquidate the assets.

Selling to an Outside Party

This is the method most likely to yield the best value and terms provided the business is one that is attractive to an outside party. Many businesses are not attractive to buyers, especially those that are unprofitable or only marginally profitable or too dependent upon the talent and efforts of a single person. However, a profitable business whose operations could readily be assumed by a new party is often a good candidate for sale to outside buyers.

There are two basic types of buyers: financial and strategic buyers. Most buyers are financial buyers. They will value the business based on a financial analysis of its operations with little, if any, regard to how this business might impact other businesses. A strategic buyer’s analysis, however, will not only focus on the target business but also on what enhancements that acquiring this business might garner for their existing business; or as some put it: will one plus one equal three? A strategic buyer can be expected to be willing to pay premium above what a financial buyer would pay. For most practical purposes, relatively few small businesses make good strategic acquisitions and most buyers will value businesses based on historical financial performance.

There are two types of business sales: an asset sale or a stock sale. An asset sale is a sale of all or some of the business' assets, possibly along with the assumption of selected liabilities. A stock sale, on the other hand, is the sale of the legal entity, or specifically the company’s stock. The business does not change, simply its ownership. If the business being sold is not a corporation that sale will be structured as an asset sale as there is no stock to be sold. The subject may arise in the sale of a corporation where sellers generally prefer stock sales while buyers usually want the transaction to be an asset sale. There can often be quite a bit of negotiation about this, but most small and mid-sized business sale transactions are structured as asset sales.

Buyers generally prefer asset purchases

- They can buy just those assets that they want. A list is created and Bill of Sale drawn up. In sales of smaller businesses the buyer may only purchase the physical assets (inventory and equipment) and perhaps contracts in progress, assuming the customer agrees, while the seller keeps the cash and accounts receivables.

- They can avoid assuming the liabilities (known and unknown) of the business or at least pick and choose which liabilities they will assume.

- If there is potential litigation or other claims against the former owner, the buyer is much less likely to be drawn into them after an asset purchase, whereas in a stock purchase, the same legal entity is still in existence and may be subject to all such claims.

- They can allocate much of the purchase price to the assets which can be depreciated or amortized generating tax deductible expenses. If an asset had been depreciated by the old owner, even to zero, a new owner can get a new depreciable life, reducing taxable income. Whereas if the stock of the firm had been purchased, the depreciated book value of the asset would remain unchanged.

- Sales tax will most likely be due on many of the tangible assets purchased.

- Buyer and Seller must agree to how the purchase price will be allocated among the assets. The tax impact of this will mean that some portion of the sales price will be taxed to the seller as income and some as capital gains.

Sellers generally prefer a stock sale

- The sale of the corporate entity,( rather than a sale of its assets) taxed at capital gain rates, usually results in a smaller tax bill for the seller.

- An asset sale of a “C” corporation could result in the corporation paying capital gains tax on the sale of its assets and then the owners paying tax again after they receive the net proceeds from the corporation, a double taxation problem that the sale of “S” corporations or LLCs generally don’t cause.

- By transferring the entire business entity, the seller is generally free of any liabilities, known or unknown, pre-existing or subsequent, related to the corporation.

Sellers should realize that if they press hard for a stock sale because of the favorable capital gains treatment, buyers, should they still wish to move forward with the transaction, will likely press for a lower price to compensate for the benefits they give up.

Seller Financing

Most sales of small or mid-sized businesses, whether to outsiders or insiders, require at least some seller financing, commonly a down payment and a promissory note with regular monthly or quarterly payments. An SBA-guaranteed loans often require the seller to “keep some skin in the game”, meaning they will want the seller to carry a partial note subordinated to the bank's note. The seller’s benefits typically include a higher price and quicker sale and an income stream and tax deferral, as the payments are stretched over a few years.

Employee Stock Ownership Plan (ESOP)

Many business owners contemplating selling their business will be exposed to the idea of setting up an ESOP. ESOPs are a complex subject beyond the scope of this article but I will highlight a few key points. An ESOP is an employee retirement plan, much like a profit sharing plan, that is authorized to invest in the employer's stock. The main reason ESOPs appear attractive to a business owner is the tax deferral on sale proceeds received from the ESOP. Once an ESOP owns 30% of the shares of a company the selling shareholders can invest in qualifying securities (many corporate securities qualify) and defer paying capital gains tax until they sell those securities. If they die before selling those qualifying securities capital gains taxes might be avoided altogether or for years down the line depending on how long their spouse lives or how large their estate is.

In its simplest form, a business owner, with sufficient time for planning might set up an ESOP, fund it regularly with tax-deductible cash contributions, and then use that cash to buy the owner's shares over a period of years. Likely the ESOP would start with an initial purchase of at least 30% of the shares to take advantage of the tax deferral provisions. Often, the business owner may not want to take years to sell the shares and may utilize a leveraged ESOP wherein a bank loan is used to fund the purchase of the owner's shares. The ESOP and loan payments are structured such that the principal payments on the loan are effectively tax deductible.

Any business owner contemplating selling their shares to an ESOP should seek expert advice. However, they should also be aware that some proponents of ESOPs are almost religious in their fervor for them. While there are tax advantages, the price paid for the shares must be set by an independent appraiser who will value them based on a financial analysis. There will be no strategic premium. If a bank loan is used to fund the share purchase the seller will often have to personally guarantee that loan until it is repaid making it risky to simply cease involvement in the business’s management. The debt on the company’s books can act to actually reduce the business’s value until it is paid off. Finally, a key consideration is who will manage the firm once the owner steps aside? Are they capable of managing on their own or will you need to remain actively involved until the ESOP loan is paid off several years down the road?

There are many aspects to ESOPs that can be examined in a longer discussion, particularly as regards to operating a business owned, or substantially owned, by an ESOP, and the benefits to employees, that require careful consideration and detailed legal, accounting, financial planning and tax advice. There are some very successful ESOP-owned companies. Nevertheless, many business owners may find that an outright sale of a business will garner more value with less risk. Often business owners turn to ESOPs when they can’t find a buyer. With an ESOP they essentially create a buyer.

Selling to Employees or Family

This is a time honored method of transferring ownership. When selling to employees or family members typically great care is taken in selecting just which individuals should be brought into ownership. A program is then developed, often with the help of attorneys or consultants who specialize in such internal transfers of ownership, for the principal shareholders to slowly sell their shares to their employees over time. The methods by which the employees finance these purchases vary. They include bank loans to the employee(s), bonuses of cash or shares from the employer/owner, dividends received by the shareholder/ employee. Some firms that set up key man life insurance may use the cash value of the insurance policies to buy the shares from the principals. Some may make the mistake of saying that the company will just buy them out on a promissory note, which they then structure, impacting the firm's financial statements and causing great problems with their banker when they next report financial statements.

There are definite risks with employee buyouts. There may be good that reasons the employees are employees and not owners. They may simply not have what it takes to be an owner and be in charge. Or the entrepreneur may find that while he places a substantial value on his equity in the business, a value that is backed up with formal appraisals, the staff doesn't value the equity so much and resent the cash burdens that buying him out place on them. Perhaps they just want a job, their salaries, and maybe their bonuses. Perhaps they feel that after years of service that the firm should be effectively given to them. Similarly family members may not have the capability, financial capacity or interest to pay the market value for and effectively operate the business. Many companies have gone into successful successions of ownership, but it is important to plan it carefully with professional advice, if the owner is to increase the likelihood of receiving a fair value for his or her equity.

Liquidation

This option will probably realize the least value for the business owner, though it may be the only one available if the business is really just a one-person operation, is financially distressed, or is simply not attractive to a buyer. Depending on the business, this option can actually be fairly expensive because it may be difficult to reduce your expenses as fast as you wind down your revenue generating activities. You may incur lease termination costs, selling expenses on the disposal of assets, and even a period of operating losses until you are finally able to close the doors. There will be no value received for the “goodwill” of an ongoing business, so this option is hardly recommended for anyone who actually has a viable business that might be of interest to someone else. You must carefully plan such a close-down process in order to net as much cash as you can.

Selling Your Business

The sale of a business is a complex subject, and there are entire books devoted to each of the options discussed here in these few paragraphs. Operating a business and selling a business call upon quite different suites of skill, training and experience. For best results a team is required that can integrate the legal, financial and marketing elements. Typically a certified business broker can get a higher price for a business and get it in a shorter period of time, as the owner concentrates on running the business well, and developing his or her exit strategy while maintaining the all-important confidentiality throughout the process.

The Sunbelt Network is world’s largest and oldest business brokerage network with over 250 offices around the globe, and over 40,000 small and mid-sized business sale transactions completed. The San Francisco territory, headquartered in Alameda, is staffed with experienced, highly trained agents, most of whom have run their own businesses. The credentials held by the local staff include that of CPA, Attorney, Financial Analyst, broker and Certified Business Intermediary.

Selling your business may well be one of the most important decisions you make in your lifetime. Understand your motivations, consider the options, assemble a seasoned team, and pursue your goal.

For more information visit http://www.sunbeltbayarea.com or call Kris Moe at 707-529-6458

Bill Mitchell can reached through his website, http://califbusinessbroker.com/

Why A Business Broker Should Be Used in Selling your Business

Why A Business Broker Should Be Used?

A business broker, or intermediary, is a remarkably valuable asset when selling your business. They specialize in preparing, marketing and pricing your business for a successful sale allowing you the peace of mind to run your business throughout the process.

1. Integrity and Excellence

Each of our agents holds a high value towards honesty and reliability; many having been business owners themselves, making it easy for them to relate to this process. We understand how important it is to keep every sales transaction confidential so others will not discover your intent to sell prematurely. We value our professionalism, ethics and integrity, always remembering the Golden Rule, “Respect others, and treat them the way we would want to be treated.”

2. Invaluable Industry Experience

Your business broker at Sunbelt has taken the necessary time to learn the proper procedures in order to accommodate your every need, which is why our closing success rate is at 73%. That is 52% HIGHER than the national average! We make sure each agent only has a limited number of listings so that we are better able to provide you with the personal care that you not only need, but deserve. Being proactive in managing our listings is our focus. Rather than letting our listings sit on our website, we update finances quarterly and expedite mailings monthly.

3. A Marketing Plan That Works for You

Your business broker will first evaluate your business to help you find out what the business is worth and help you decide if anything needs to be changed in order to maximize the selling potential on the current market. If the time is right, we move forward in signing agreements and begin the process of packaging your business with the utmost confidentiality. Your listing will be posted on twenty-one web pages and potential business buyers will be targeted. Your business broker will be with you each step of the way to walk you through our seamless process. Sunbelt is known for specializing in businesses with revenue from $500,000 to $30 million in industries such as Manufacturing, Wholesale, Distribution and Business & Personal Services.

4. Access to Eager Potential Buyers

With 235 offices, Sunbelt is the largest brokerage/mergear acquisition company in the world and has access to the largest buying pool. We service geographical regions such as San Jose, Sunnyvale, Santa Clara County, San Mateo County, Santa Cruz County, south Alameda County, Campbell, and the entire Greater Bay Area. Each of the contacted buyers is financially capable and seriously interested in furthering their business acquisitions.

5. A Brokerage Firm Provides You Peace of Mind

Business brokers are able to easily navigate through the complicated process of selling your business. Selling your life’s work is understandably emotional, and such sentiments can work against you during a sale. It usually takes six-to-nine months to sell a business. Allowing one of our experienced agents to assist you will help you achieve your financial sale goal while maintaining your peace of mind.

Contact one of our brokers today at 707-529-6458

What to Do After Buying an Existing Business?

There are many advantages to buying a pre-existing business. While there may be upfront costs to consider when it comes to purchasing, the risk is much lower than it would be to build a business from the ground up. Plus, as the buyer, you could also acquire important assets, such as patents, copyrights, community good-standing and even essential personnel.

Before buying a business you’ll want to consult with a certified appraiser, business broker, and other professionals to ensure that due diligence is completed, terms are negotiated, and the price is fair. After the deal closes, it’s time to get to work—but what should you do first after buying an existing business?

The Transition Phase

After the acquisition takes place on paper, there may be a period of transition, where the managerial shift will take place. Instead of jumping in full-steam ahead, it’s best to watch and learn for a bit, unless you have intimate knowledge of the industry.

The Learning Process

Before you start implementing any policies, procedures or changes, you’ll want to learn everything you can about the day-to-day, inter-workings of each department and how they currently operate. Keep the lines of communication open with the former owner, and pick their brain for insights and information. Also, if applicable, research clients and customer’s experience; what are they lacking? Are they unsatisfied with the service? What additional assets can you provide to enhance their experience?

Working with Existing Employees

Chances are the business you’ve purchased will retain some of the existing employees. To officially introduce yourself and get off on the right foot, hold a company-wide meeting with all employees. Stress your optimism about the future of the firm, quell their fears about their positions, and make yourself available to any queries or concerns they might have. The goal of this meeting is to set their minds at ease.

It could also be a good idea to have each member of your staff to prepare a report that outlines their duties, and perhaps even suggestions they might have for their position and the business as a whole. These reports can be helpful for your understanding of the company and can assist you as you evaluate changes that need to be made.

Taking the Reins

Sooner or later it will come time for you to take the reins. It may feel necessary to make the place your own by repainting, redecorating, or reorganizing before you get down to business. To make things more manageable, try making a 30/60/90-day plan to implement any new changes, while you work towards an official business plan. A business plan doesn’t have to be mammoth document, but rather an outline that includes but is not limited to:

- The direction you want to take the business

- How it is going to get done

- Who is going to do what

- A rough timeline of completion

- How you will measure success

Ultimately, buying an existing business is a challenging yet rewarding experience. If you’re in need of any guidance at any point in the process, contact me to help you buy or sell a business and to answer any questions you may have.

10 In-Demand Businesses

Are you ready to roll up your sleeves and enter the hustling, bustling world of entrepreneurship? Discover some of the most in-demand businesses for sale in 2016 and which industries are the most profitable. You may just find your calling!

1.) Healthy Fast Food

As healthcare continues to advance, people are becoming more and more knowledgeable about the way our decisions impact our bodies. As a result, many have become increasingly observant of the food they are consuming – yet cooking healthy doesn’t always fit into a hectic schedule.

Healthy fast food and dining options have exploded in recent years to meet the needs of the increasingly health-conscious public. Several of the fast food chains that have and continue to do well in 2016 are Panera Bread and Chipotle Mexican Grill, healthier alternatives to the typical hamburger joint.

2.) Health Clubs and Fitness Centers

In addition to eating healthier, people are placing a strong emphasis on staying active. No longer are we in the days of Richard Simmons and Jane Fonda workout tapes. Now, the health club industry is booming with new types of health clubs – and it’s all about the experience. Not only are fitness centers helping people reach their fitness goals, but they are also creating a fun, social environment to encourage members to try new workouts and enjoy the burn!

Fitness centers that have been most successful are the ones that are taking a new approach to fitness. Some franchised gyms that are flourishing include Orangetheory Fitness, Pure Barre, and CorePower Yoga.

3.) Social Media Consulting

As social media continues to gain traction among people of all generations, it is critical that companies participate in order to remain relevant. But what happens when a company doesn’t have the resources or know-how to maintain social media accounts? After all, there are so many outlets and so little time.

Many businesses are outsourcing their social media to professionals with a background in Internet marketing and social media services. In order to help companies reach new audiences through outlets such as Facebook, Twitter, Pinterest, Tumblr, and Snapchat, a number of social media consulting companies are emerging.

4.) Senior Services

As life expectancy continues to increase and the baby-boomer generation begins to age, there is no shortage of customers in need of senior services. Because many seniors are unable or uncomfortable leaving home, there are a variety of opportunities to service the elderly. From in-home salon services and errand services to home management and more, there are a number of small businesses that flourish in this industry.

5.) Real Estate Offices

Although the real estate market is heavily dependent on the condition of our economy, the industry is extremely profitable right now. According to Sageworks, the average net profit margin for a real estate office was 15.19% between September 2014 and August 2015. If you’re looking for a business with high profitability and low operating costs, owning a real estate office might be an opportunity for you to consider in 2016.

6.) Environmental Consulting

As consumers become more eco-conscious and businesses are forced to comply with a growing list of environmental regulations, the environmental consulting industry is ramping up. In order to ensure business practices are in accordance with the latest environmental regulations, many businesses hire environmental consultants. If you’re looking for a business that is steadily growing, as well as making a positive impact on the environment, environmental consulting might be the perfect business opportunity for you!

7.) Smartphone Repair Services

We live in a world where smartphones are practically glued to our hands. When a gadget breaks, it impacts our productivity and ability to communicate with others. Unless you have phone insurance, it can be extremely costly to replace your device. Instead of spending an arm and a leg on a replacement phone, smartphone repair shops have emerged. Oftentimes, smartphone repair companies are able to fix smartphones quickly and at a fraction of the replacement price.

Companies such as CPR Cell Phone Repair and uBreakiFix have locations nationwide that service not only smartphones, but tablets, laptops, and game consoles as well. As smartphones have become somewhat of an addiction for many people, the smartphone repair business is looking like a great 2016 business prospect.

8.) Pet Related Services

Animal lovers are crazy about their pets – they’re part of the family after all! With that said, it’s a safe bet that any pet related business is going to flourish. From veterinarians’ offices and dog walking services to dog spas and doggy day camps, there are endless ways to enter this industry.

Be sure to think outside of the box! DoodyCalls is one of the many unique (and smelly) franchise opportunities in the pet service sector. According to its site, DoodyCalls is a “dog pooper scooper service for your yard, cat litter box cleaning, patio/deck deodorizing, as well as pet dog waste station set up and maintenance for communities.” With hundreds of millions of animals in the United States, its safe to say there is enough “business” to go around.

9.) Design Services

Companies are always trying to put their best foot forward, so it should come as no surprise that businesses are willing to spend some serious money to ensure their website, office, products, advertisements, and office space look modern and professional. From graphic design and web design to industrial design and interior design, the design services industry is thriving! In fact, Entrepreneur.com suggests that the design services sector is among the top 15 most profitable small business industries in 2016, with an average net profit margin of 11.4 percent. If you have an eye for design, explore business opportunities in this exciting industry!

10.) Translation Services

In an increasingly connected world, people of different backgrounds need a way to communicate with one another – cue translation services. International businesses pay big bucks for dual-language speakers, especially as companies continue to expand into new countries. According to IBISWorld, businesses will continue to grow internationally over the next five years; that means new marketing materials, a translated website, and new dual-language relationships.

If any of the above in-demand businesses and industries for 2016 interest you, take the next step and learn more! Contact your local Sunbelt Business Brokers office and we would be happy to help you find a business in any of the above industries. With more business listings than any of our major competitors combined, we’re sure to have an opportunity that will interest you!